Spark transforms medtech company

The challenge

This client is a Swedish MedTech company, listed on Nasdaq Stock Exchange. It started in the mid-’90s and had a revenue peak at +100 MSEK in 2009. Since the peak, revenues had declined to approximately 50 MSEK in 2018, and the company had to rely on multiple capital raises to run operations.

Even though the market was growing, and the company had a good product-market fit, they had challenges with revenue growth and reaching profitability.

The company had won a couple of large tenders and entered new international markets. A real achievement for the company, but they struggled with delivering and were burdened with the surprisingly complex and costly international deals.

Significant contracts did not achieve expected profit levels and the cost structures within the company had not been properly evaluated.

The product strategy did not include a clear pricing strategy nor ways of increasing product profitability.

The Spark Engagement

Spark conducted an assessment of the company and based on the results, carried out a Product-Led Transformation™, led by a Spark team consisting of Product Management, Operations and Sales.

Deliverables

Spark worked hands on shoulder to shoulder with the team to achieve the following deliverables:

PROFITABILITY:

We established cost management and control within the company as well as rigorous external vendor reviews. By calculating product profitability, cost consciousness was increased.

We analyzed product profitability and changed the pricing model to reflect true product value. We also changed annual licensing sales pricing to reflect market standards and were able to increase pricing significantly and prepare the customers for SaaS pricing.

MARKETING:

Spark created an entirely new marketing strategy with an improved alignment with the customer journey, including the value propositions of the product portfolio. We built and launched a new, bilingual website that communicates the value of the company and its products. Spark also reviewed the usage of social media in marketing and suggested significant improvements to boost awareness of their products. A new platform for digital communication was implemented.

SALES:

Spark introduced a new sales approach and implemented sales funnel management with forecasting and prioritization on sales activities. These actions resulted in proactive sales, improved forecasting, and more efficient supplier management.

OPERATIONS:

We coached the Operations team to adopt the mindset of being a professional buyer. The Product-Led Transformation™ approach revealed a lack of review of subcontractors, both in terms of quality, delivery times, and pricing. Essential actions were taken reduced to the delivery time from 5 months to 4 weeks while maintaining pricing and quality.

PRODUCT SUCCESS:

The product-solution was developed and introduced as a complete concept – A lightweight and practical portable measuring unit, an easy-to-use system, including hardware, software, and all necessary equipment. New Product packaging and pricing was introduced and released, enabling an additional market to be addressed successfully with increased revenue.

ORGANIZATION:

During the transformation, Spark reinstated the product management function to lead product-success, resulting in a stronger product-oriented mindset throughout the company. Four new key employees were hired, including the CEO.

EQUITY ReSULTS

The work that Spark did produced the deliverables above and measurable improvements in several financial KPIs:

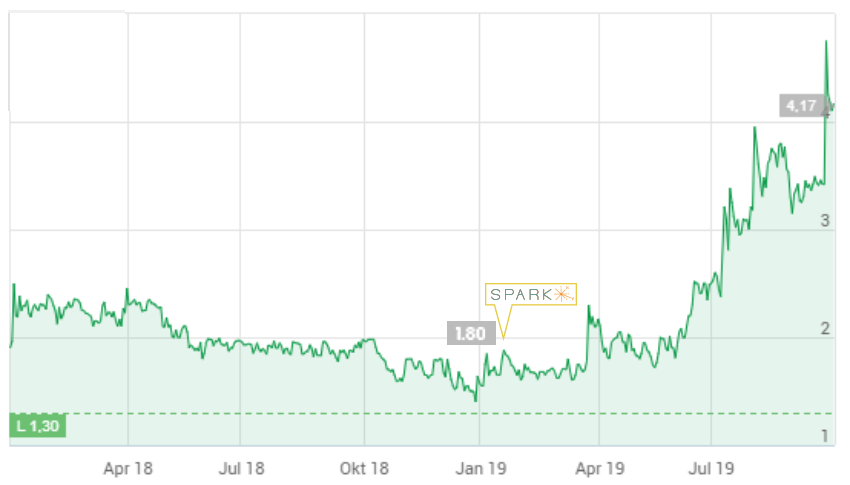

- When Spark came onboard in January 2019, the share price was 1,8 SEK/Sh and reached 4.17 sek/sh by September of the same year.

- The company’s share price increased by 132% within six months after Spark’s engagement started.

- Market cap increased 283% while Spark was on board.

- The company successfully achieved two capital injections.

- Unnecessary spending was reduced by 3% because of our in-depth spend analysis.

- Trading volumes increased significantly.

When Spark came onboard the medtech company in late January 2019, the share price was 1,8 SEK. We immediately initiated several product focused projects. One quarter later we could see share prices increasing gradually, to significantly accellerate two quarters into the year.